Car depreciation calculator tax

It is determined based on the depreciation system GDS or ADS used. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

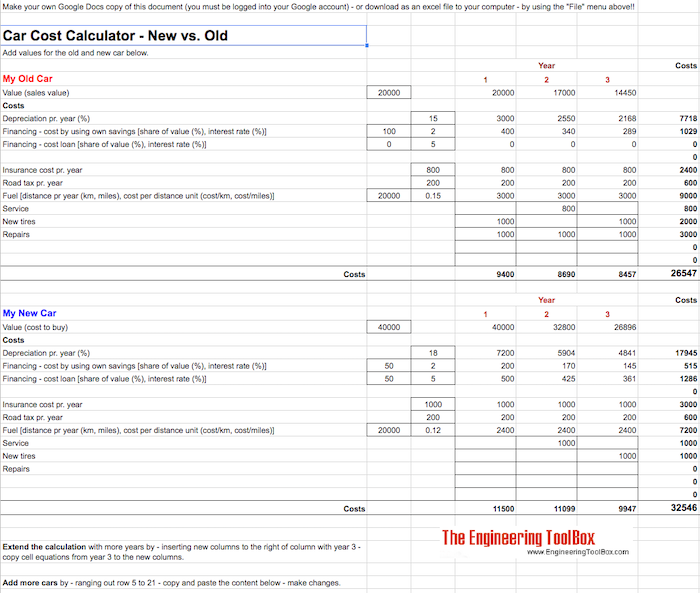

Cars New Vs Old Car Cost Calculator

When its time to file your.

. Example Calculation Using the Section 179 Calculator. There are basically two choices of calculation method of depreciation of a motor vehicle for tax purposes. Car Depreciation Calculator.

The tool includes updates to. The formula for calculating vehicle depreciation is fairly simple. D P - A.

This limit is reduced by the amount by which the cost of. Ad Our Resources Can Help You Decide Between Taxable Vs. The recovery period of property is the number of years over which you recover its cost or other basis.

This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. The depreciation is calculated by applying the vehicles depreciation. Loan interest taxes fees fuel maintenance and repairs.

Calculate the cost of owning a car new or used vehicle over the next 5 years. C is the original purchase price or basis of an asset. Section 179 deduction dollar limits.

Calculate your vehicle depreciation Determine how your vehicles value will change over the time you own it using this tool. 12180 divided by 35880 x 100 3394 thats the depreciation rate Using this formula its a breeze to. 100000 miles used to.

Car Depreciation Calculator Depreciation is what makes cars so expensive to own. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly. IQ Calculators hopes you found this depreciation schedule calculator useful.

Just subtract your cars present fair market value from the purchase price sales. 35880 new-car value - 23700 cars current value 12180. Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime.

In fact the cost of your new car drops as soon as you drive it off the dealership lot. For 1-2 year old car the depreciation rate is 20. Both calculation methods contain.

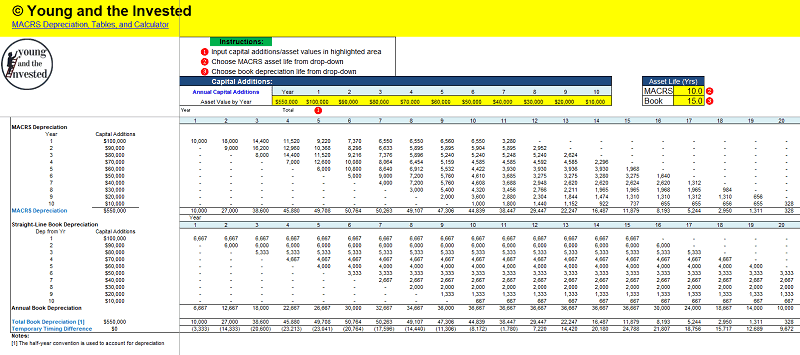

The MACRS Depreciation Calculator uses the following basic formula. D i C R i. R i is the.

We base our estimate on the first 3 year. To calculate your deduction multiply the number of. The yearly depreciation of a car is the amount its value decreases every year.

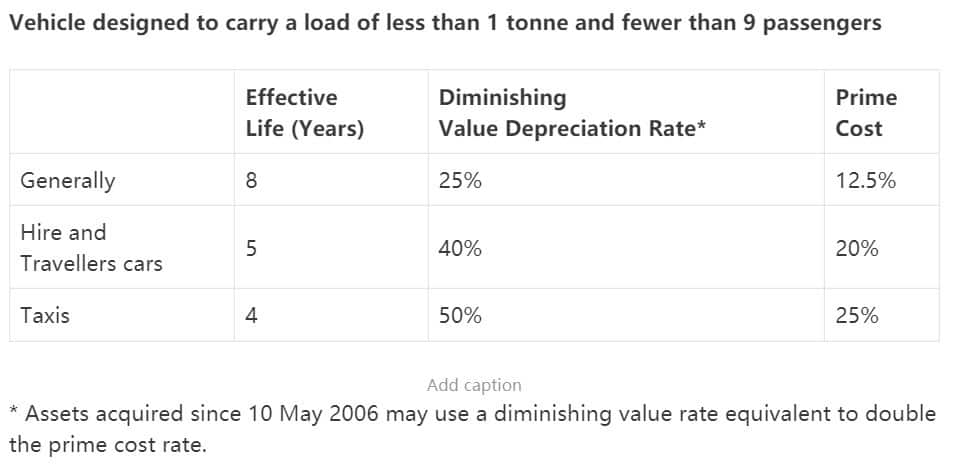

A P 1 - R100 n. Diminishing Value and Prime Cost. How to Calculate Depreciation.

Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. This includes a Nissan TITAN and TITAN XD. Where A is the value of the car after n years D is the depreciation amount P is the purchase.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. SLD is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles.

Edmunds True Cost to Own TCO takes depreciation. Work-related car expenses calculator. Before you use this tool.

To calculate the depreciation of your car you can use two different types of formulas. Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Car depreciation refers to the rate at which your car loses its value from the first year you bought it.

So 11400 5 2280 annually. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. 18100 First-Year Depreciation for Qualifying Models.

We will even custom tailor the results based upon just a few of. Qualifying vehicles must have had a gross vehicle weight rating of over 6000 lbs. Prime Cost Method for Calculating Car Depreciation Cost of Running the Car x Days you owned 365 x.

Where D i is the depreciation in year i. It can be used for the 201314 to. The Car Depreciation Calculator uses the following formulae.

Section 179 deduction dollar limits.

Depreciation Of Vehicles Atotaxrates Info

Depreciation Of Vehicles Atotaxrates Info

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Free Macrs Depreciation Calculator For Excel

Depreciation Rate Formula Examples How To Calculate

Car Depreciation Calculator

/desk-writing-work-pen-office-business-676191-pxhere.com-ff806b26e1734bde82038a304564daf8.jpg)

What Is The Tax Impact Of Calculating Depreciation

Prime Cost Straight Line And Diminishing Value Methods Australian Taxation Office

Depreciation Of Vehicles Atotaxrates Info

Macrs Depreciation Table Calculator The Complete Guide

Depreciation Rate Formula Examples How To Calculate

Depreciation Of Vehicles Atotaxrates Info

How Is Car Depreciation Calculated Credit Karma

Annual Depreciation Of A New Car Find The Future Value Youtube